Brief Update on: India to Become Self-Sufficient in Medical Devices

By 2030, India will require $50 billion in medical devices. If the native industry does not expand owing to technological or policy constraints, large-scale imports will fill the gap. It is time for India to capitalize on its strengths, strengthen local production, and cement its position as a medical device industry leader. Despite the fact that the National Medical Devices Policy, 2023 represents a considerable step forward, the difficulties of import dependence and underutilized domestic potential remain.

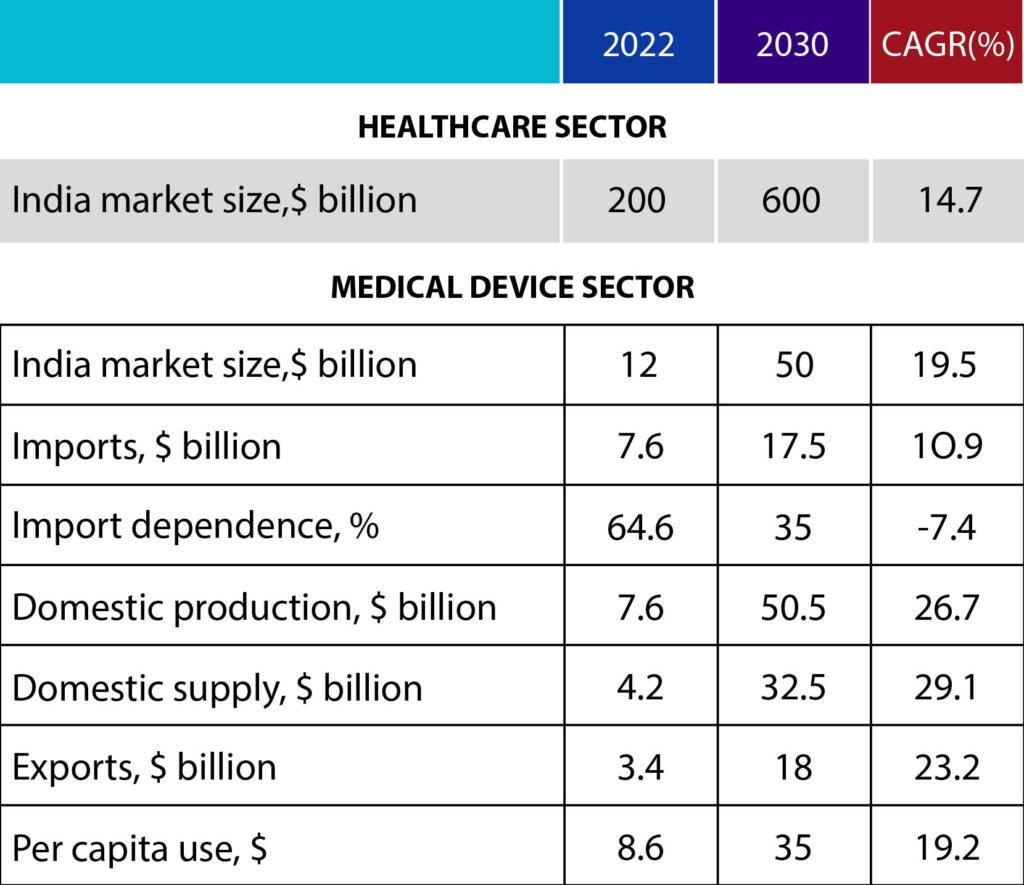

India manufactures around $7.6 billion in medical devices, $3.4 billion of which is exported and the remaining $4.2 billion is used domestically. However, India’s yearly demand for medical devices is assessed at $11.8 billion, with imports accounting for $7.6 billion. Thus, imports represent for 65 percent of total market demand, while domestic enterprises meet only 35 percent.

Looking for Medical Device Regulatory Consulting?

Lets have a word about your project?

The sector might grow from over $12 billion now to $50 billion by 2030. By 2030, India’s medical device industry will have reduced its reliance on imports from 64.6 percent to 35 percent and increased exports from 3.4 billion to 18 billion. It has the potential to create approximately 1.5 million employment in medical device manufacturing and healthcare services like as hospitals and laboratories.

India ranks among the top ten global producers of a wide range of medical products, including syringes, needles, IV cannulas, surgical blades, surgical gloves, contraceptives, intraocular lenses, orthopaedic trauma implants, stents, ventilators, and X-ray equipment. It manufactures a wide range of high-end and vital medical devices, including heart valves, joint implants, robotic-assisted surgical systems, radiotherapy equipment, ophthalmic excimer lasers, and high-end operating microscopes.

The medical device market is still more underserved. In comparison to the global per capita spending on medical devices of $75, India spends only $8.6. However, this is expected to rise to $35 per capita as India’s healthcare business grows from roughly $200 billion to around $600 billion by 2030. Significant expenditures from corporate hospitals, telemedicine, and medical tourism will drive growth. Extending global medical equipment trade from $450 billion to $800 billion by 2030 would also assist.

Policy Intervention

Achieving the full potential of the sector will require further support from the government as the sector faces 15 percent cost disability due to among other factors the high cost of power and supply chain inefficiencies. Here are some suggestions for the government.

- Adjust customs duty:

– Raise basic customs duty for non-ITA 1 medical devices from 0-7.5% to 15-20%.

– Applied to products with quality production and exports around Rs 20 crore.

– Successful example with mobile phones – a 20% duty-boosted manufacturing.

– Comparatively, global import duties vary by 14% in Brazil, 0-15% in Russia, 3.3-17% in China, and 0-20% in South Africa.

- Restrict input tax credit (ITC):

– No ITC for IGST on zero customs duty imports.

– Pre-GST, importers paid 6% countervailing duties and 4% special additional duties without tax credits.

– ITC for IGST benefits importers, causing local manufacturers to shut down units.

- Ban used/refurbished imports:

– June 19, 2023 order permits the import of used medical devices, posing risks.

– Used devices from developed countries harm domestic production.

– Developed countries and China disallow used product imports.

– Old devices are cheaper but threaten government initiatives and domestic production.

– Old devices risk faulty diagnostics, contamination, and environmental harm.

- Introduce PLI plus scheme and promote local sourcing:

– Launch performance-linked incentive (PLI) plus scheme for high import-intensive products.

– Incentivize value addition over mere assembly of imported components.

– Promote local sourcing, especially during crises like Covid-19.

– Enable Indian manufacturers to compete with foreign imports in government tenders and healthcare emergencies.

In the journey towards making India self-sufficient in medical devices, Operon Strategist stands as a guiding light in the realm of medical device regulatory consulting. With our expertise and comprehensive approach, we pave the way for a future where India takes charge of its healthcare destiny, ensuring innovation, quality, and self-reliance in medical devices. Contact us now to market your product worldwide.

-

Operon Strategisthttps://operonstrategist.com/author/snehal/

-

Operon Strategisthttps://operonstrategist.com/author/snehal/

-

Operon Strategisthttps://operonstrategist.com/author/snehal/

-

Operon Strategisthttps://operonstrategist.com/author/snehal/